A general observation that’s easy to make is how our habitual misunderstanding of Modern Fiat Money divides us against each other. A particular example is playing out, as I write, in my home state of New Mexico. The community is acrimoniously divided over proposed legislation requiring business owners to offer PAID LEAVE to employees needing time off for personal or family emergencies. What is interesting to observe, in this instance, is that the two sides in the debate—small business owners and social-minded progressives—are not divided by disagreement over whether the community would be better off if emergency-stricken employees could maintain their income while temporarily away from work—meaning they could pay their rent and utilities, buy food and gas, and continue to patronize various local businesses. No—if you step back, it’s clear the underlying division of the debate lies in our popular misunderstanding of money itself.

Here is the letter I wrote to our local newspaper trying to point this out:

PAID LEAVE requires Understanding Fiat Money

The paid-leave debate (Santa Fe New Mexican, Feb 20) is a good example of how confusion about our sovereign fiat money system divides us—unnecessarily—against each other. In this case, the division occurs because our habitual (and unquestioned) “money logic” tells us that paid leave, if it is to happen, must be paid for by employers. This proposition creates real challenges for small businesses operating on slim profit margins with a small workforce. As a result, these business owners are divided against those who see, foremost, the social and family health benefits of a paid leave program.

The crucial point to see is that we can imagine the argument ending—the small business owners and the social progressives becoming united in pursuing something demonstrably in the interest of our common welfare—if only there were someone else to write the “leave paychecks.”

But who else could write those interim paychecks? Certainly, raising state taxes to foot the bill is a non-starter. And asking the federal government to increase taxes or borrow more dollars to underwrite a universal paid leave program seems, well, inconceivable—especially in today’s political-economic chaos. But the truth is, if the Sovereign Fiat Money System we’ve been using now for over half a century is properly understood, our national government could write those paid leave paychecks—could do so without either raising taxes or borrowing dollars that must be repaid with future taxes—and arguably ought to do so as a matter of “fiscal responsibility” in pursuit of our collective well-being.

Paid Leave is just one example of how our misunderstanding of Modern Fiat Money divides us into competing factions. Politicians sense this and relentlessly take advantage of it by reinforcing the money-misunderstanding at every opportunity— playing us against each other to garner votes and power. This is one of the ironies of our political-social chaos today: If we truly understood that taxes do not pay for federal spending—and Treasury bond operations do not “borrow” dollars that must be repaid with future taxes—we could be having an entirely different conversation. We could be asking ourselves, for example, who would be harmed by a universal PAID LEAVE program? And if nobody is harmed—while the general well-being of our local communities and economies is helped—then what exactly is there to argue about?

John Alt, in the high-desert south of Santa Fe

Will the Santa Fe New Mexican publish this short opinion piece? The odds are likely against it—which leads me to consider another layer of difficulty we confront: Is it possible that our Popular Misunderstanding of Money is so difficult to dispel—or even openly talk about—precisely because it divides us? Is there something built into the structure of our social relationships that makes us want to be a part of one or another opposing faction? Is the other option—participating in a united effort to undertake and accomplish something that under-girds our collective well-being—is that option so antithetical to our nature that we’re not even interested in discussing how, IN FACT, we can pay ourselves to accomplish it? And, if that is the case, can we then turn it around? Can we imagine that understanding our misunderstanding could, possibly, ever-so-slightly, begin restructuring this dysfunctional part of our nature?

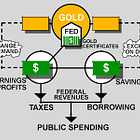

Click below to review the basics of Modern Fiat Money that underpin this essay.

While what follows may appear critical of banks' current financial advantages, we need to emphasize that the extensive banking infrastructure already in place is precisely what we need to manage a future tokenized financial world.

By tokenized world we mean an infrastructure in which an account will contain many different asset identifiers called tokens. Such diverse token types will encompass traditional notions of fiat moneys, new CBDCs, real estate and other titles, equity shares, bonds, intellectual property rights, carbon credits, loyalty rewards, and digital collectibles - each represented as a standardized token within the same secure banking infrastructure.

The current obsession with blockchain technology represents an unnecessary distraction. At its core, a database—whether distributed or centralized—simply organizes and stores information, much like a kitchen cupboard. We don't consider the cupboard itself to add significant value to its contents beyond providing secure storage. Similarly, the underlying database technology is far less important than the financial systems, regulatory frameworks, and trust mechanisms built around it.

The existing banking system, with its established security protocols, regulatory compliance, and interconnected networks, provides a ready foundation that can evolve to accommodate tokenized assets. Rather than rebuilding this infrastructure from scratch through blockchain, we should leverage and adapt what already works.

On the money infusion side of a fiat system, we've currently granted banks tremendous privilege through their ability to create money through lending. This is particularly evident with mortgage loans, where banks generate a 30-year revenue stream while artificially dividing payments into "principal" and "interest" portions. This system allows financial institutions to profit substantially from what is essentially a form of private money creation - a benefit typically reserved for sovereign entities. Such arrangements represent a significant wealth transfer mechanism that operates largely unquestioned within our financial system.

A fiat currency system undermines the conventional justification for interest rates. Traditionally, interest represents compensation paid to capital owners for temporarily surrendering their scarce resources. However, when a sovereign government can create capital at will to meet any rational economic need, the fundamental premise of capital scarcity dissolves. In this framework, interest rates become less about compensating for foregone capital use and more about a policy tool for economic management.

This realization exposes how deeply our economic thinking remains tethered to commodity-money concepts, even decades after abandoning the gold standard. The persistence of interest as a "natural" feature of money reflects our collective failure to fully internalize the implications of a true fiat system, where capital need not be scarce when legitimate productive capacity exists to absorb it.

The heart of modern banking's contradictions is that banks pay interest on savings primarily to maintain the illusion of the traditional banking model, where deposits fund loans. In reality, with fiat currency systems, banks create money when they issue loans - they don't actually "lend out" deposits.

This interest on savings accounts serves several purposes: it preserves the narrative that banks need your money; banks compete for deposit market share; it creates customer loyalty and account stickiness; it maintains the appearance of the money multiplier model. Most significantly, it perpetuates the myth of capital scarcity in a system where such scarcity is actually artificial. This illusion serves financial institutions well - it justifies charging much higher interest on loans than they pay on deposits, creating their profit margin.

If the public fully understood that banks create money when lending rather than reallocating existing money, it would fundamentally challenge banking's role as privileged intermediaries in the monetary system.

The cornerstone of effective monetary policy is recognizing that a central authority—the government—must maintain exclusive control over money creation and removal. This authority alone should determine when to infuse new money into the economy or extract existing money through taxation.

The cryptocurrency movement fundamentally challenges this principle, driven by an inherent distrust of centralized control. However, this central authority serves a crucial balancing function: it must carefully manage liquidity to prevent inflation while ensuring adequate economic stimulus. When increasing money supply, it must verify that production capacity and supply chains can meet the resulting demand. Conversely, when excessive liquidity threatens price stability, it can remove money through taxation.

Importantly, tax revenue in this model isn't collected to fund government operations—since the government can create necessary funds—but rather to regulate the money supply and maintain economic balance.

This monetary approach functions exclusively at the federal level. Since individual states lack currency-creation authority, they must continue relying on taxation to fund their operations and meet local needs. This creates an inherent tension in a federal system with fiat currency—the federal government can create money at will, while states remain dependent on tax collection for revenue. This disconnect between federal monetary sovereignty and state fiscal limitations represents an unresolved challenge within our federal structure.

In summary, the federal government does not require tax revenues to fund its operations or initiatives. The common refrain "my taxes are paying for..." fundamentally misrepresents how a fiat currency system actually works. In a true fiat monetary system, where the government controls currency creation, such statements are conceptually incorrect. Federal spending is not dependent on tax collection, making such taxpayer claims essentially meaningless.

We must also recognize that issuing interest-bearing Treasury securities is no longer necessary to finance government operations. These instruments have evolved primarily into safe, interest-generating havens where wealthy individuals and institutions can park their capital. Rather than fulfilling their original purpose of government funding, Treasury bonds now effectively serve as government-guaranteed investment vehicles for the financial elite.