"Fiscal Responsibility"

A New Definition for a world of Modern Money

Okay, this is a deep dive-but that’s how far we need to go now to reach the roots of this weed that’s rampantly overtaking the garden of the American Dream. Take a deep breath:

Ostensibly, all the craziness since Trump’s inauguration has been about saving the American taxpayers money, right? Elon Musk’s DOGE is in high gear toward cutting the government’s personnel, research, and foreign aid expenses by a trillion dollars. Trump wants Zelensky to capitulate to Russian aggression so America can, first, stop wasting taxpayer’s money on Ukraine’s defense and, second, get repaid—in rare-earth metals! —for past assistance already given. Peace in Gaza is about a real-estate deal that will bring billions more to U.S. coffers when the extravagant, Trump-branded, Gaza resorts and condos hit the market. Tariffs on America’s trading partners will bring in such a flow of new revenue that taxes can be virtually eliminated on America’s super-rich. “Gold Cards” will be sold to wealthy immigrants, cutting America’s “deficit” by further billions. And that’s just Trump and Musk—all by themselves.

Speaker of the House Johnson and the Republican Congress want to save taxpayers even more: All those dollars the government spends on Medicaid, helping poor families cope with medical costs—not to mention cancer research, weather forecasting, national park and forest services, flu vaccinations, electric car-charging grids…sorry, out-of-breath! There’s just so much money to be saved everywhere you look. And we can’t waste a moment getting it done, because the longer we delay, the higher the national debt stacks up.

None of this desperate zaniness, of course, would have any traction—or even have gotten out of the starting gate—if the American people hadn’t already been convinced it was true: America really is broke and (as even Barack Obama finally pronounced) using a credit card to buy things it can’t afford. So, we continue to allow ourselves to be convinced it’s time to tighten up—like a family looking at its paycheck stubs, trying to decide whether to repair the leaking roof or replace the balding tires on the station wagon.

But here’s the thing: this anxious narrative about the U.S. sovereign government needing to be “fiscally responsible” by cutting back on what it spends and finding new sources of revenue—shall we begin selling the National Parks to billionaire developers? —is based on an understanding of money as out-dated as treating feverishness with leeches and bloodletting. Though our current legislators don’t want us to see or understand it, Modern Fiat Money—for the sovereign nation that issues it—simply doesn’t work that way.

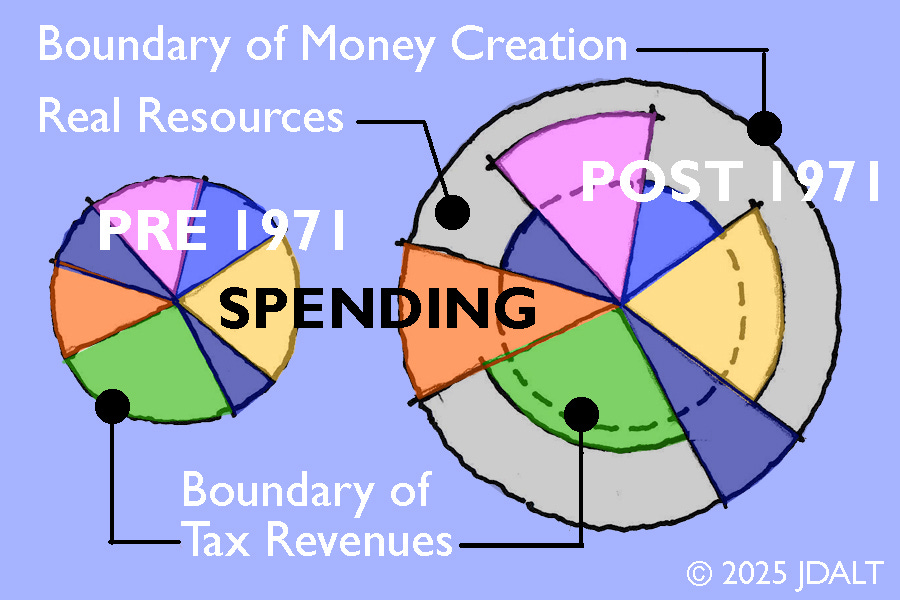

Half a century ago, and long, before that, “Fiscal Responsibility” meant something far different than what it logically means today. Back then, a U.S. dollar was a placeholder for gold—a placeholder that could be converted, on demand, to 35 ounces of a finite gold-stock stored in vaults at Fort Knox, Kentucky. Back then, how many U.S. dollar “gold certificates” the government issued was of consequence to the “soundness” of money itself. Back then, taxes provided the currency for Federal spending. Back then, if the government needed to spend more than its tax revenues, it had to BORROW dollar gold-certificates—and repay that debt with future tax revenues.

Today, none of that is true. Digital U.S. Reserves (fiat dollars) and paper Federal Reserve Notes (fiat dollars) are issued as necessary for the purpose of—guess what? —meeting the needs of our collective well-being. Large portions of those needs are provided for by the profit-making, entrepreneurial activities of Private Enterprise—and the sovereign central bank (the FED) issues digital Reserves and paper fiat dollars, as necessary, to enable those private ventures to undertake what they deem to be most profitable. Doing so—ensuring currency liquidity for Private Enterprise transactions—is legitimately considered, today, a primary “fiscal responsibility.”

But that’s only half the story. Our collective well-being cannot be provided for only by things Private Enterprise finds profitable to produce—not by a long-shot. There are other things we need as well, goods and services that don’t make profits because there is no consumer willing or able to buy them at a profit-making price. Cancer research. Weather forecasting. Remedial reading instruction. Fighting wildfires. Nuclear submarine maintenance. Natural disaster recovery. Toxic waste cleanup…. I’m getting breathless again.

To pay for these kinds of things, it turns out, our Modern Monetary System also issues fiat dollars—as necessary. There is no need to levy new taxes. There is no borrowing of dollars that must be repaid with future taxes. When the U.S. Congress makes the determination that our collective well-being requires a good or service that Private Enterprise cannot provide for profit—and when Congress then directs the Treasury to buy that good or service, the Modern Fiat Money system simply issues the fiat dollars necessary for that purchase to be made. Except for periods where political posturing in Congress has intentionally obfuscated and hamstrung this reality (as is happening again as I write) fiat money operations have been providing for our collective well-being for over half a century.

Which suggests an entirely new definition of “fiscal responsibility” itself:

When there is (A) consensus acknowledgement that something is clearly needed for our common welfare—something that Private Enterprise won’t produce because it’s not profitable; and (B) it’s determined the real resources required to provide for that need are, indeed, available; then (C) it is “fiscally responsible” to issue the fiat money necessary to marshal those resources and address the need.

What is “fiscally irresponsible” is to do A and B, but then say C is not possible because taxes cannot be raised to pay for it. What is “fiscally feckless” is to deny the collective need matters, or even exists, based on their not being “enough money” to pay for addressing it. What is “fiscally INSANE,” however, is to accuse the collective need itself of “wasting” taxpayer’s dollars—and use that as justification for dismantling our common health and prosperity in the name of “saving money.”

To review the operations of Modern Fiat Money underpinning the logic of this essay, click here:

I am ready for this thinking, John. Thank you. Now, to get it into the minds of our elected representatives.